Vista 401(k) Plan

FAQ

How does Vista 401(k) work?

- Traditional 401(k) Plan: Contributions to the plan are made through regular payroll deductions; selections from 21 mutual funds are available; no taxes are paid on any contributions or earnings until they are withdrawn. Upon withdrawal ordinary income tax rates will apply. The Vista 401(k) Plan is specifically designed to help you save for retirement. During your working years you make tax-deferred contributions, which can be invested in one or more of the available funds. Taxes remain deferred on your contributions, earnings or any capital appreciation until you withdraw your money from the plan. The plan saves you money because your per-pay-period contributions reduce your taxable income.

- Roth 401(k) Plan: All contributions are made on an after-tax basis. Qualified withdrawals are tax free.

Who can join?

All full-time and part-time employees of the participating Employer Sponsors are eligible to participate in the Vista 401(k) Supplemental Retirement Plan

How much may I contribute?

The maximum you can contribute to your account is limited by federal tax law. The annual limit is $24,500. If you are 50 years old or older you can contribute another $8,000 for a total of $32,500. The yearly contribution limits apply to the Traditional and Roth 401(k) Plans combined. It is NOT $32,500 per plan.

Note: This figure may change each year as the maximum amount is indexed on an annual basis by the IRS.

Can I change my contribution amount?

What happens if I discontinue contributions?

Your account continues to enjoy tax-deferred earnings if you selected a Traditional 401(k) Plan. If you selected a Roth 401(k) Plan your account continues to enjoy post-tax earnings. You will continue to enjoy the same benefits as other participants.

When can I receive my plan money?

You may withdraw your money from the Vista 401(k) Plan when you have reached 59.5 years of age or have terminated your employment. The IRS does allow provisions for hardship. Specific criteria are listed in the “Vista 401(k) Plan Highlights”, found under the “401(k) Plan” tab. Many of the same rules apply to the Roth 401(k) Plan. However, the Roth does not allow you to remove funds for 5 years following your first contribution.

Can I withdraw from my 401(k) account like my savings account?

Can I borrow from my plan account?

Your 401(k) plan has a loan provision to give you access to your money. There are certain rules that apply:

- You must have a minimum of $2000 in your account.

- You can borrow up to 50% of your account balance, with a maximum of $50,000.

- Minimum loan amount is $1000.

- You have up to 5 years to repay the loan.

- Only one loan is permitted at a time. There is also a (30) day waiting period to acquire a new loan after paying off an existing loan

- The interest rate will be 2% over Prime, however repayment of both principal and interest is re-deposited into your account.

- There is a $85 loan processing fee.

How am I taxed on my plan money?

The money you contribute to your traditional 401(k) is not taxed until you receive a qualified distribution from your plan. All contributions are pre-tax, thereby reducing your taxable income. If you select the Roth 401(k) each contribution is after-tax and grows tax-free, with qualified withdrawals in retirement being tax-free.

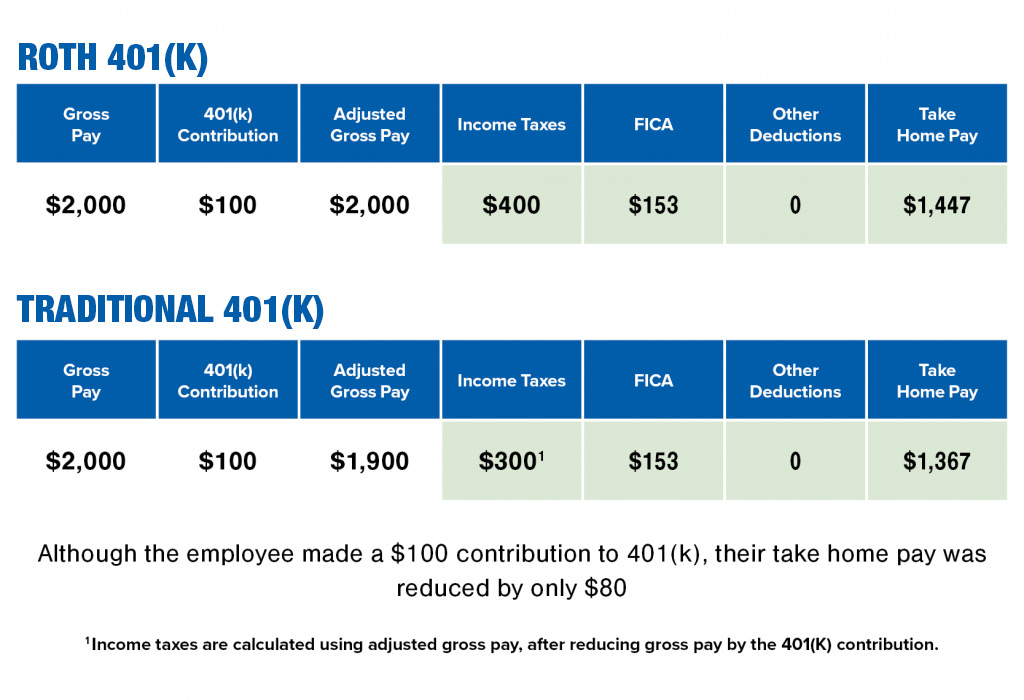

“The chart below compares the Traditional 401(k) Plan to the Roth 401(k) Plan. The chart illustrates the tax savings for an employee earning $2000 per pay period, income taxes of 20% based on deductions, 7.65% FICA tax, and a contribution of $100 per pay period for both the Roth and Traditional 401(k) Plans.

Please contact the Retirement Services Department at (866) 325-1278 for additional information.

Is there a time when I must receive payments from the plan?

Yes, just like IRAs or other retirement plans, you must begin receiving payments from your Traditional 401(k) account starting with the year after the year in which you achieve age 73. However, if you selected a Roth 401(k) plan, you are not required to take distributions.

Do I have a choice of plan investment options?

What is a mutual fund?

How do I get additional information or enroll in Vista 401(k)?

You may request an Enrollment Form or get additional information by calling the Retirement Services Team at 1-866-325-1278 (M-F, 8 a.m.- 5 p.m.). You may also visit the Vista401k.com homepage and click on the “Account Login/Enroll” box at the top of the page.”

Mail your completed form to Vista 401(k) at P.O. Box 1878, Tallahassee, Florida, 32302-1878.

Simply complete the form indicating:

- The per pay period amount you want to contribute.

- How you want your money invested.

- The beneficiary who will receive your account in the event of your death.

Does Vista 401(k) have representatives onsite at school locations?

What are the qualifications for taking a loan from my Vista 401(k) Account?

You must have a minimum account balance of $2,000 to begin a loan. The minimum loan amount is $1,000. Your loan cannot exceed 50% or account assets and cannot exceed $50,000. You may not have more than one loan active at any given time. Once a loan is paid off there is a 30 day waiting period before a new loan may be taken.

How can I pay off my loan early?

Call the Retirement Services Department at (866) 325-1278 for instructions.

I am about to receive a DROP payout. Can I rollover some or all of the money into my 401(k) Plan?

Yes, you may roll over all or a portion of your DROP payout into your Traditional Vista 401(k) plan. However, you cannot roll DROP funds into your Roth 401(k) plan. Contact our office at 866-325-1278 for forms or questions regarding this process.

When I retire, do I have to take a lump-sum payout of my 401(k) account?

Can I rollover my other 401(k) or 403(b) account(s) into my Vista 401(k) account?

You can rollover your other previous employer’s Traditional 401(k) and Traditional 403(b) accounts at any time. You may rollover current employer Traditional 403(b) accounts into your Traditional Vista 401(k) account as long as you meet certain IRS requirements:

- You are over the age of 59 ½ OR

- No longer working for the plan sponsor of your Traditional 403(b) account

- Rolling over funds to your Traditional 401(k) account may be a good way to cut expenses and keep more of your returns.

NOTE: You cannot roll your Traditional 401(k) account into your Roth 401(k) account under the Vista 401(k) Plan.

I am almost 73 or older. Do I need to take action to receive my Required Minimum Distribution (RMD)?

No, this is not required. The Vista 401(k) Plan automatically calculates your RMD amount and sends out a check to the address on file. Contact our office to update your contact information if needed. The Roth is an after-tax vehicle and grows tax-free, with qualified withdrawals in retirement also being tax-free. No RMD is required for the Roth 401(k).

Note: If you remain employed, you are not obligated to start taking your RMD at 73 years of age.

How can I reset my account password?

I will be out of school soon for the summer. Do I need to stop contributions to my 401(k) account?

When will I receive an account statement?

Participant statements are posted to your account online after each quarter. If you wish to receive a hard copy you must visit your account online and change the option from paperless. If you have any questions please contact the Retirement Services Department at (866) 325-1278.

I designated a beneficiary when I signed up for benefits with the School District. Does that apply to my 401(k) account?

I took a hardship from my account. Do my contributions have to stop?

Home | About Us | 401(k) Plan |401(k) Funds | Learning Center | Blog | Contact Us

P.O. Box 1878 Tallahassee, Florida 32302-1878

866-325-1278