Get the latest 401(k) news!

Know what’s happening with your Vista 401(k) account.

Table of Contents

- Q3 2025 Vista Plan Performance and Market Conditions

- September 2025 Plan Performance Chart

- The Importance of Investing in your Vista 401(k) Plan While You’re Young

- It’s Never Too Late to Invest in Your Vista 401(k) Plan

- Traditional 401(k) vs. Roth 401(k)

- Nuts and Bolts – How to Invest Your DROP Funds

- The Drop Box

- Helpful Hints

Welcome to Vista 401(k)!

Q3 2025 Plan Performance

By Constantine Mulligan, Director of Investments Partner, Cerity Partners LLC

Vista 401(k) Plan Fund Performance

For retirement plan portfolios, the macro backdrop continues to support a balanced but cautious stance. The U.S. economy appears positioned for slower, but sustainable, trend-level growth, while global conditions remain uneven. Inflation is easing without clear signs of a hard landing, allowing central banks to transition toward gradual rate normalization.

Key themes to monitor:

- Moderating growth and policy easing suggest continued support for both equities and fixed income, with less volatility than in prior tightening phases.

- Fixed income opportunities are improving as yields remain elevated relative to recent history; a steeper yield curve may benefit intermediate maturities.

- Credit spreads remain tight, warranting selectivity in high yield and corporate credit allocations.

- Equities continue to offer growth potential, especially in quality and technology sectors benefiting from AI investment trends. However, valuation discipline remains critical.

- Global diversification may contribute to risk management, but tariff exposure and slower growth abroad warrant caution.

Overall, the data continues to support moderate growth, somewhat controlled inflation, and policy flexibility and clarity. For plan sponsors and investment committees, this environment argues for maintaining long-term strategic allocations while using near-term opportunities in fixed income and quality equities to reinforce plan design resilience.

The Plan’s well-structured and broadly diversified investment menu remains a cornerstone of long-term retirement readiness. Spanning asset classes, geographies, and sectors, the lineup is built to weather volatility and deliver consistent value. Participants continue to benefit from a resilient suite of high-quality fund options tailored to support a wide range of investment goals and risk profiles.

For our clients who wish to take a deeper dive, we have provided the following economic and market commentary. This will provide an explanation of the overall macro and micro economic factors influencing the markets and, in turn, your Vista 401(k) account. If you have any questions or wish to discuss these matters in greater detail, please contact us at 866-325-1278 or e-mail us at 401k@vista401k.com.

3rd Quarter 2025 Economic/Market Recap & Outlook

Despite persistent forecasts for slowdown, the U.S. economy continues to demonstrate notable resilience. In the second quarter, GDP expanded by 3.8%, driven by 2.5% consumer spending growth and a reduction in imports following prior inventory buildups ahead of new tariffs. This rebound offset a weak first quarter, placing first-half growth near the long-term trend of 2.0%. Early estimates for the third quarter, including the Atlanta Fed’s GDPNow forecast of 3.9%, suggest continued momentum.

The strength of the consumer remains the central story. Higher wages, solid job growth, and rising asset values, particularly in equities and housing, continue to support spending, though the impact is concentrated among higher-income households. Business investment is also contributing meaningfully, particularly in software, intellectual property, and infrastructure tied to artificial intelligence (AI). AI-related capital spending, along with power generation and data center expansion, remains a secular growth driver expected to persist into 2026.

Looking ahead, growth should moderate toward the 2.0% trend rate by year-end as tariffs and tight monetary conditions begin to weigh on household demand and hiring. While housing remains weak, AI-driven productivity investment and a modest boost from import substitution could cushion the slowdown. Fiscal spending should become slightly contractionary as federal employment normalizes.

Outside the U.S., growth remains mixed. Europe continues to avoid recession, though expansion is expected to be roughly half the U.S. pace. Increased infrastructure and defense spending, particularly in Germany, and prior monetary easing from the European Central Bank (ECB) should help stabilize activity.

In Asia, Japan’s growth is projected just below 1.0%, constrained by tariffs and rising long-term rates that burden its high debt levels. China remains intent on meeting its 5% growth target, but overcapacity, weak property markets, and slower exports pose significant challenges. Domestic demand remains insufficient to sustain long-term momentum, and continued stimulus may provide only temporary relief.

The Federal Reserve has shifted more clearly toward easing as employment growth slows and past GDP revisions reveal weaker underlying momentum. Following a 25-basis-point (bps) rate cut in September, two additional cuts are expected before year-end. The Fed is likely to bring the policy rate to around 3.0% in 2026, assuming inflation continues trending toward its 2% target.

The ECB appears near the end of its own easing cycle, holding its key rate at 2.0% with inflation near target. Further cuts would depend on evidence of tariff-related weakness. The Bank of England, balancing modest inflation progress with sluggish growth, is expected to make one additional rate reduction this year. The Bank of Japan remains highly cautious, maintaining minimal rate hikes and beginning only gradual balance-sheet reduction, while China’s central bank faces competing pressures of currency stability and inflation risk, leading to a measured approach to stimulus.

The combination of monetary easing and moderate inflation pushed Treasury yields lower in the third quarter, with the yield curve steepening modestly as short-term rates fell faster than long-term yields. The historical curve inversion (one of the longest on record) is slowly unwinding without a recession. U.S. Treasurys continue to attract robust domestic and international demand, distinguishing the U.S. market from other high-deficit nations such as the U.K., France, and Japan. Treasury issuance has been tactically managed toward shorter maturities to ease long-end supply concerns.

Credit conditions remain stable. High-yield spreads hover near historic lows, reflecting confidence in the growth outlook and limited near-term default risk. Investment-grade spreads are similarly tight. In municipals, heavy issuance earlier in the year, amid fears of potential changes to tax exemptions, led to underperformance, though relative stability has since prompted partial recovery. States with significant fiscal deficits may continue to face localized supply pressures.

Global equities delivered strong results in the third quarter, led by the U.S. The combination of steady growth, improving earnings (on pace for roughly 10% annual growth), and a dovish Fed supported valuation expansion. Improved trade rhetoric and effective corporate tariff mitigation also boosted sentiment and margins.

The market rally continues to be powered by technology and communication services firms benefiting from the AI boom. These companies have maintained high earnings growth that largely justifies elevated valuations. Broader participation in cyclicals could emerge as easing policy and steady demand extend the expansion into year-end.

While valuations are elevated and talk of an equity “melt-up” persists, fundamentals remain supportive. Earnings growth, disciplined cost management, and a favorable liquidity backdrop should prevent material multiple contraction as the Fed continues easing.

In Europe, equity valuations remain attractive, but tariff exposure and slower growth pose challenges. Sustained profitability discipline could support moderate gains from relatively cheap levels. Japan’s equities benefited earlier from a favorable U.S. trade deal but now face headwinds from slowing exports and rate uncertainty. In China, targeted fiscal measures and investor enthusiasm for AI-linked firms have provided a floor to performance, though structural property and demand issues persist.

In precious metals, gold prices remain supported by expectations for lower real interest rates amid central bank easing, particularly from the Fed. However, speculative flows are rising, and valuations suggest the potential for bubble-like conditions if policy easing persists longer than expected. The U.S. dollar regained some strength during the third quarter, buoyed by superior growth fundamentals and higher relative yields. However, prospective Fed rate cuts in 2026 should limit further appreciation from current levels.

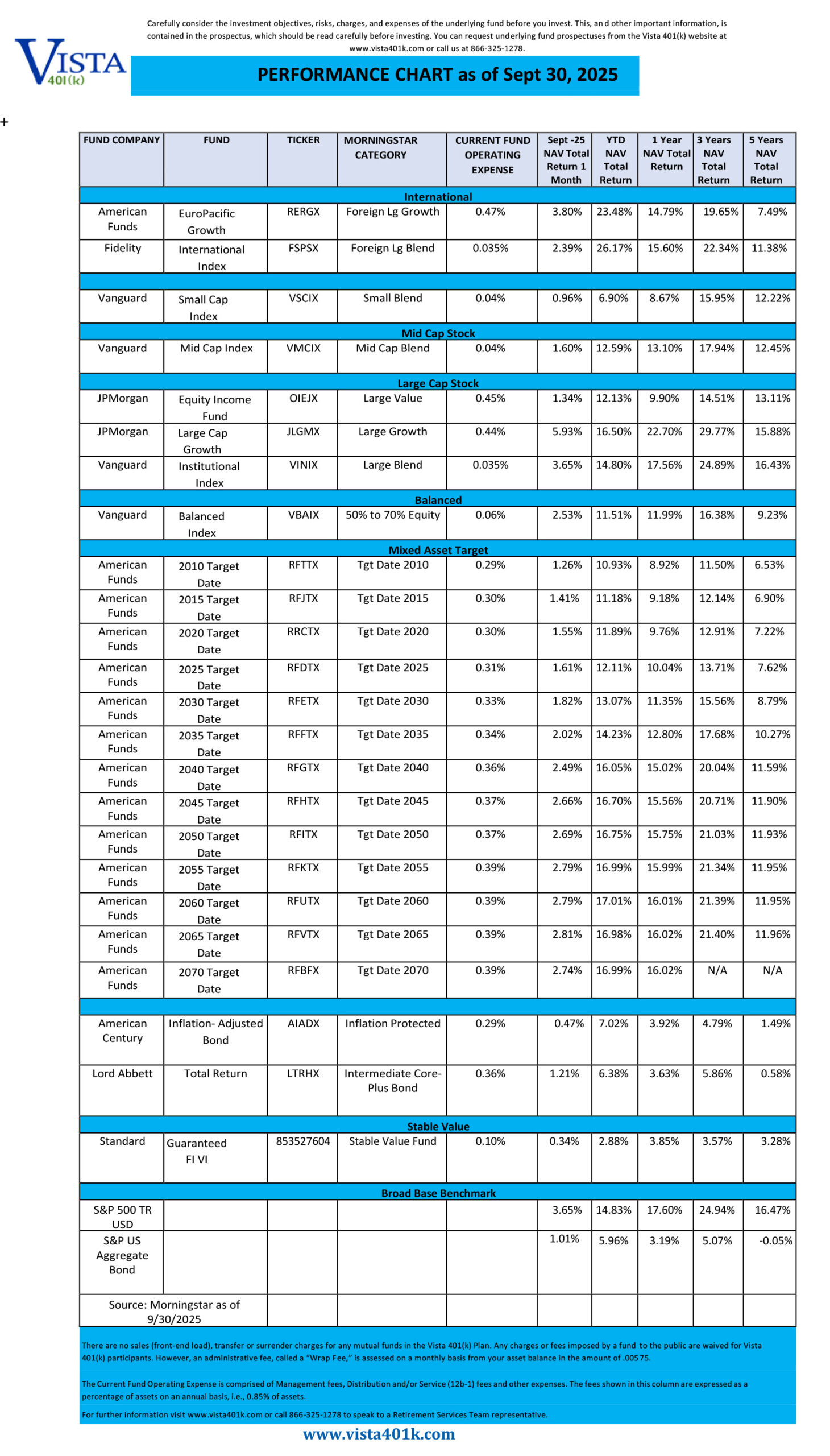

September 2025 Fund Performance Chart

The Importance of Investing in your Vista 401(k) Plan While You’re Young

One of the smartest financial decisions you can make early in your career is to start contributing to your Vista 401(k) retirement plan. While retirement may seem far away when you’re in your 20s or 30s, the truth is that time is your most valuable asset when it comes to building long-term wealth. Investing in your Vista 401(k) retirement plan while you’re young allows you to take advantage of compound growth and tax benefits – both of which can set you up for financial security later in life.

The Power of Compound Growth

The greatest advantage of starting early is the power of compounding. Compounding occurs when your investment earnings generate additional earnings over time. Essentially, you earn interest on your contributions and on the growth those contributions have already produced. The earlier you start, the more time your money has to grow exponentially.

Reduce Financial Pressure Later in Life

Investing in your Vista 401(k) early also reduces the financial burden of saving for retirement as you get older. When you start young, smaller, consistent contributions can grow into significant savings over time. Waiting until your 40s or 50s to start means you’ll need to contribute much larger amounts to reach the same goal—often at a time when you might also be paying for a mortgage, children’s education, or other financial responsibilities. Early investing gives you flexibility and peace of mind later on.

Tax Advantages That Help You Grow Faster

A Vista 401(k) plan offers significant tax advantages that can help your savings grow faster. Traditional 401(k) contributions are made with pre-tax dollars, meaning you lower your taxable income today and defer paying taxes until retirement, when you may be in a lower tax bracket. Alternatively, Roth 401(k)s allow you to contribute after-tax income, so your withdrawals in retirement are tax-free. Either way, you’re taking advantage of tax benefits that help your money work harder for you.

Building Financial Discipline and Security

Finally, investing early in your Vista 401(k) helps you develop good financial habits. Regularly setting aside part of your income for the future teaches discipline and builds a foundation for long-term financial stability. It also provides a safety net—knowing that you are consistently building a retirement fund gives you greater confidence and security as you navigate your career and life’s financial ups and downs.

In Conclusion

Investing in your 401(k) while you’re young isn’t just about preparing for retirement—it’s about taking control of your financial future. By starting early, you harness the power of compounding, benefit from tax advantages, and develop strong saving habits. The earlier you begin, the less you’ll need to sacrifice later—and the more freedom you’ll enjoy when it’s time to retire.

It’s Never Too Late to Invest in Your Vista 401(k) Plan

When it comes to saving for retirement, one of the most common misconceptions is that if you didn’t start young, you’ve missed your chance. In reality, it’s never too late to begin investing in your Vista 401(k) plan. Whether you’re in your 40s, 50s, or even approaching retirement age, contributing to a Vista 401(k) plan can still have a meaningful impact on your financial future. The key is to start now and make the most of the tools available to help you catch up and grow your savings.

Time Still Works in Your Favor

Even if you’re getting a late start, time remains a powerful ally. While younger investors benefit from decades of compounding growth, older investors can still take advantage of compounding on the contributions they make today. Every dollar you invest continues to earn returns over time, and those returns earn additional returns. The sooner you start, the more opportunities your money has to grow, even if retirement is only 5, 10, or 15 years away.

Higher Contribution Limits for Catch-Up Savings

One major benefit for older investors is the ability to make “catch-up” contributions. The IRS allows workers age 50 and older to contribute more to their 401(k) account than younger employees. In 2025, the standard contribution limit is $23,500 per year, but those 50 and older can contribute an additional $7,500—for a total of $31,000 annually.

These higher limits allow you to accelerate your savings in the years leading up to retirement. By maximizing these contributions, you can make up for lost time and significantly increase your nest egg in just a decade or two.

Tax Advantages That Strengthen Your Finances

A Vista 401(k) plan provides powerful tax advantages, regardless of when you start contributing. Traditional 401(k) contributions are made with pre-tax income, which lowers your taxable income today and allows your investments to grow tax-deferred until you withdraw them in retirement. For many older workers who are in their peak earning years, this tax reduction can be especially valuable.

Alternatively, contributing to a Roth 401(k) allows you to pay taxes now and enjoy tax-free withdrawals later. Depending on your financial situation and retirement goals, either option provides important tax benefits that can strengthen your overall financial position.

Every Contribution Counts

Finally, it’s important to remember that something is always better than nothing. Even small, consistent contributions can make a real difference over time. The key is to start where you are, contribute what you can, and gradually increase your contributions as your budget allows.

In Conclusion

It’s never too late to invest in your Vista 401(k) plan. Whether you’re catching up or starting fresh, you still have time to take advantage of compounding growth and tax benefits. The most important step is to take action today. Every contribution you make brings you closer to a more comfortable, confident, and financially secure retirement.

Traditional 401(k) vs. Roth 401(k): Understanding the Key Differences

When planning for retirement, one of the most important decisions you’ll make is choosing between a traditional 401(k) and a Roth 401(k). Both are powerful retirement savings tools that allow you to invest through your employer, but they differ in how and when you pay taxes. Understanding these differences can help you choose the plan—or combination of both—that best fits your financial goals and tax strategy.

The Core Difference: When You Pay Taxes

The main distinction between a traditional 401(k) and a Roth 401(k) lies in when you pay taxes on your contributions.

- Traditional 401(k): Contributions are made with pre-tax dollars, which means they reduce your taxable income in the year you contribute. You don’t pay taxes on the money you put in or on any investment earnings until you withdraw the funds in retirement. At that time, withdrawals are taxed as ordinary income.

- Roth 401(k): Contributions are made with after-tax dollars, meaning you pay taxes now on the money you contribute. The advantage is that your withdrawals, including both contributions and investment earnings, are completely tax-free in retirement, as long as you meet certain conditions (such as being at least 59½ and having the account for at least five years).

In short, a traditional 401(k) gives you a tax break today, while a Roth 401(k) gives you a tax break in the future.

Choosing Based on Your Tax Bracket

A key factor in deciding between the two is your current and expected future tax rate.

- If you expect to be in a lower tax bracket during retirement, a traditional 401(k) may be the better choice. You’ll benefit from lowering your taxable income now, then pay less tax later when you withdraw.

- If you expect to be in a higher tax bracket in retirement—or if you’re early in your career and your income is likely to grow—a Roth 401(k) may be more advantageous. You pay taxes now when your rate is lower, and your withdrawals later will be tax-free.

For many people, using a combination of both accounts can help balance tax exposure over time.

Required Minimum Distributions (RMDs)

A Traditional 401(k) plan is subject to required minimum distributions (RMDs). RMDs are mandatory withdrawals that begin at age 73 under current IRS rules. However, Roth 401(k) plans are not subject to RMDs. This means that you, the participant, are not obligated to take withdrawals at any age.

The Bottom Line

Both the traditional and Roth 401(k) offer valuable benefits—it’s not about which one is “better,” but which one aligns with your financial situation and retirement goals. If you want immediate tax savings, you should consider a Traditional 401(k). If you prefer tax-free income in retirement, you should consider the Roth 401(k). For many savers, a mix of both provides the best of both worlds—tax diversification that offers flexibility no matter how future tax laws or personal circumstances change.

By understanding how each works, you can make informed decisions today that pave the way for a stronger, more tax-efficient retirement tomorrow.

If you have additional questions, please reach out to the Retirement Services Department at (866) 325-1278.

Nuts & Bolts: How to Invest Your DROP Funds

How to Invest DROP Funds in Your Traditional Vista 401(k) Account:

- Let the Florida Retirement System (FRS) know you would like to roll your DROP funds into your Traditional Vista 401(k) Account.

- Should you choose to roll your funds into your Traditional Vista 401(k) Plan, the Vista 401(k) Retirement Services Department sends a rollover form to you to complete and return to Retirement Services.

Note: If you do not have a Traditional Vista 401(k) Account, you need only set one up prior to retirement and fund it with at least one payroll contribution. Please be aware that you cannot roll your DROP funds into your Roth Vista 401(k) Retirement Plan.

Why Roll Drop Funds into Your Traditional Vista 401(k) Account:

- Consolidation: Individuals often accumulate multiple retirement accounts over their career. Consolidating these accounts makes it easier to track performance, adjust asset allocation, and plan for your financial future. Consolidation not only streamlines your financial strategy but also provides a clearer picture of your overall retirement readiness.

- Tax Advantages: DROP funds are treated as income the year they are paid out to participants. If you do not place these funds in a tax-deferred account, the funds will be treated as income in that year. However, if you roll them into a tax-deferred plan like the Traditional Vista 401(k) Plan, taxes will be taken as you withdraw funds over the years. By then you may be in a lower tax bracket.

- Portability: Your DROP funds are portable. This means that should you choose to roll these funds out of your Traditional Vista 401(k) account, you can do so with no waiting period or penalty.

Please call us at (866) 325-1278 if you have any questions. You may also visit Vista401k.com to make changes.

The DROP Box

- Are you enrolled in DROP and close to retiring?

- Do you have questions about what to do with your DROP benefits?

- Would you like to speak with a 401(k) Plan Specialist about your distribution options?

CALL 866-325-1278 or EMAIL 401k@vista401k.com

When you retire, you don’t have the option of leaving your DROP benefits with the State of Florida. You are required to select a payout method from the following three choices:

- Lump Sum Distribution – less income tax withholding (under age 55, an additional 10% tax penalty withheld)

- Direct Rollover – no tax withholding

- Partial Distribution and Direct Rollover – some income tax withholding

Here are some good reasons to rollover the DROP payout into a Traditional Vista 401(k) account:

- If you take the DROP funds as a payment directly to yourself, these funds will be taxable income for the current tax year.

- If you qualify for normal retirement from the School Board and reach the age of 55, you qualify to withdraw your funds without incurring the age 59½ withdrawal penalty from your Traditional 401(k) Plan. This means that if you choose to rollover your DROP funds to your Traditional Vista 401(k) Account, instead of a traditional IRA, you can withdraw funds before age 59½, without a penalty.

If you entered DROP in 2020, your DROP benefit will be distributed in 2025.

We also accept rollovers from your BENCOR, 403(b) or 457 accounts, so you can have all of your retirement funds in one convenient account. Call us at 866-325-1278 or email us at: 401k@vista401k.com for one-on-one support from our experienced Retirement Services Team.

Helpful Links

The material herein is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations. Situations differ among individuals and you should not assume that these generalizations or information apply to you. Keep in mind that past performance is no guarantee of future performance, and investments involve the risk of loss of principal and earnings. Additionally, neither your employer nor the plan administrator nor FBMC is able to provide you with investment advice–if you would like specific investment advice, you should consult Cerity Partners or your own personal investment advisor.

Home | About Us | 401(k) Plan |401(k) Funds | Learning Center | Blog | Contact Us

P.O. Box 1878 Tallahassee, Florida 32302-1878

866-325-1278