Get the latest 401(k) news!

Know what’s happening with your Vista 401(k) account.

Table of Contents

Welcome to Vista 401(k)!

Q4 2025 Plan Performance

By Constantine Mulligan, Director of Investments Partner, Cerity Partners LLC

Vista 401(k) Plan Fund Performance

As we enter 2026, the investment environment is being shaped by several structural and policy-driven forces that are particularly relevant for long-term retirement plan portfolios. While near-term volatility is expected, the focus for plan sponsors should remain on how these themes influence diversification, risk management, and participant outcomes over full market cycles.

Key themes to monitor:

- Deglobalization vs. Productivity: Supply-chain reshoring and trade tensions may modestly constrain growth, but increased investment in automation, AI, and productivity-enhancing technologies is expected to offset demographic and labor headwinds in developed economies.

- Economic Growth Resilience: The U.S. economy is expected to remain near trend growth in 2026, supported by fiscal policy, capital investment, and AI infrastructure spending, with a low near-term recession risk.

- Monetary Policy Path: Inflation progress has slowed, suggesting a cautious central bank approach. Modest rate cuts are possible, but policy is likely to remain restrictive relative to prior cycles.

- Market Breadth and Equity Leadership: Equity markets may experience broader participation beyond recent mega-cap leadership, benefiting cyclical sectors, small- and mid-cap stocks, and select international markets.

- Fixed Income and Deficit Risk: Yield curve steepening and rising government debt underscore the importance of diversified fixed income exposure and credit quality.

Collectively, these themes reinforce the value of disciplined diversification, long-term focus, and prudent risk oversight, which are cornerstones of a fiduciary investment framework designed to support participant retirement readiness.

The Plan’s thoughtfully constructed and broadly diversified investment lineup continues to serve as a strong foundation for long-term retirement readiness. With balanced exposure across asset classes, geographies, and sectors, the menu is designed to navigate market volatility while delivering durable, risk-adjusted outcomes. Participants are well served by a high-quality suite of investment options that supports a wide range of objectives, time horizons, and risk tolerances.

For our clients who wish to take a deeper dive, we have provided the following economic and market commentary. This will provide an explanation of the overall macro and micro economic factors influencing the markets and, in turn, your Vista 401(k) account. If you have any questions or wish to discuss these matters in greater detail, please contact us at 866-325-1278 or e-mail us at 401k@vista401k.com.

4th Quarter 2025 Economic and Market Recap & 2026 Outlook

As the global economy moves into 2026, several structural forces are shaping the investment environment in ways that are highly relevant for long-term retirement plan portfolios. Chief among these is the gradual shift toward deglobalization, the accelerating role of productivity-enhancing technologies, and a monetary policy backdrop that is transitioning from restrictive toward more neutral, albeit cautiously and unevenly across regions.

Global Economic Environment

A defining theme entering 2026 is the continued move away from globalization toward greater supply-chain security and regional self-sufficiency. This shift reflects lessons learned from the pandemic, rising geopolitical tensions, and increased nationalism. While deglobalization may introduce modest headwinds to long-term economic growth and inflation control, it is being partially offset by significant investment in productivity-enhancing technologies, particularly automation, robotics, and artificial intelligence (AI). These technologies have the potential to sustain economic growth in developed markets despite demographic challenges and slowing labor force growth.

The U.S. economy slowed modestly in late 2025, reflecting the effects of a government shutdown and tighter immigration policies. However, growth is expected to remain near trend in early 2026, supported by easier fiscal and monetary policies enacted in the second half of 2025. The extension of tax provisions, accelerated depreciation incentives, and continued investment in AI-related infrastructure (including data centers and power generation) should support both consumer and business spending. Importantly, the likelihood of a near-term recession appears low. As the year progresses, investors will increasingly focus on whether recent capital investments translate into measurable productivity gains, an outcome that will be critical to sustaining growth as labor force participation gradually declines.

Outside the U.S., Europe is expected to avoid recession, aided by fiscal support and accommodative monetary policy, even as tariffs weigh on exports. Southern European economies continue to benefit from strong services demand, while Germany remains a key swing factor. Increased defense spending in Germany represents a notable shift that could help stabilize growth. Japan is expected to post modest but positive growth, supported by domestic demand and still-accommodative policy. China faces more pronounced challenges, including tariffs, weak domestic consumption, ongoing property market stress, and demographic headwinds. Fiscal support remains critical, though policy responses may be constrained by currency considerations.

Monetary Policy Backdrop

Inflation progress slowed in 2025, largely due to tariffs and strong demand for services, though inflation is not expected to reaccelerate materially. Lower energy prices should help the disinflation process, but achieving the Federal Reserve’s 2% target may extend into 2027. With labor markets cooling, the Fed is expected to place greater emphasis on employment conditions, though lingering inflation concerns suggest a gradual approach. As a result, only one or two modest rate cuts are expected in 2026.

Globally, central banks remain cautious. The European Central Bank is likely to hold rates steady, with a bias toward easing should growth weaken. The Bank of England may pause until clearer evidence of disinflation emerges. Japan continues its slow and deliberate move away from ultra-easy policy, while China remains cautious in balancing economic support with currency stability.

Fixed Income Markets

Bond markets continue to reflect the interplay between growth, inflation expectations, and fiscal concerns. The U.S. Treasury yield curve steepened through 2025 as growth surprised to the upside and concerns over government debt increased. This reduced some of the traditional benefits of extending duration. Further curve steepening is possible in 2026, particularly those with large and growing deficits.

Credit markets remained relatively stable in 2025, though some early stress appeared in private credit. Default rates remain low, but investors are increasingly focused on underwriting discipline as the economic cycle matures. In this environment, municipal bonds appear well positioned relative to taxable bonds, supported by disciplined issuance and improving fundamentals.

Equity Markets

U.S. equities enter 2026 with strong earnings momentum. Nominal economic growth and expanding profit margins, driven mainly by productivity gains, are expected to support robust earnings growth for large-cap companies. While valuations are elevated and may limit further multiple expansion, supportive fiscal and monetary conditions should help sustain current valuation levels.

Market leadership may broaden in 2026. The small group of stocks that have driven returns in recent years may experience slower growth, while more cyclical sectors and smaller-capitalization stocks could see improving earnings and increased participation. This broader market advance would be constructive from a diversification perspective and supportive of balanced equity allocations within retirement plans. International equities may also benefit from easier monetary policy and improving earnings trends, particularly in Europe. While tariffs remain a headwind, valuation gaps between U.S. and non-U.S. markets could narrow over time. Emerging markets may see more differentiated outcomes, with Latin American economies potentially less impacted by U.S. trade policy than parts of Asia.

Key Risks to the Outlook

Risks remain meaningful and include the possibility that monetary easing proves insufficient to support labor markets, a resurgence of inflation that forces tighter policy, or disruptions to AI-related capital spending. Rising fiscal deficits could pressure bonds, while geopolitical tensions remain an ever-present wildcard. Political shifts that alter business-friendly policies or fiscal discipline could also impact markets.

Retirement Plan Implications

Overall, the outlook reinforces the importance of diversified, long-term portfolio construction. While near-term volatility is likely, the environment supports maintaining balanced exposure across asset classes, styles, and geographies, which is generally consistent with a prudent fiduciary approach focused on supporting retirement plan participant outcomes over full market cycles.

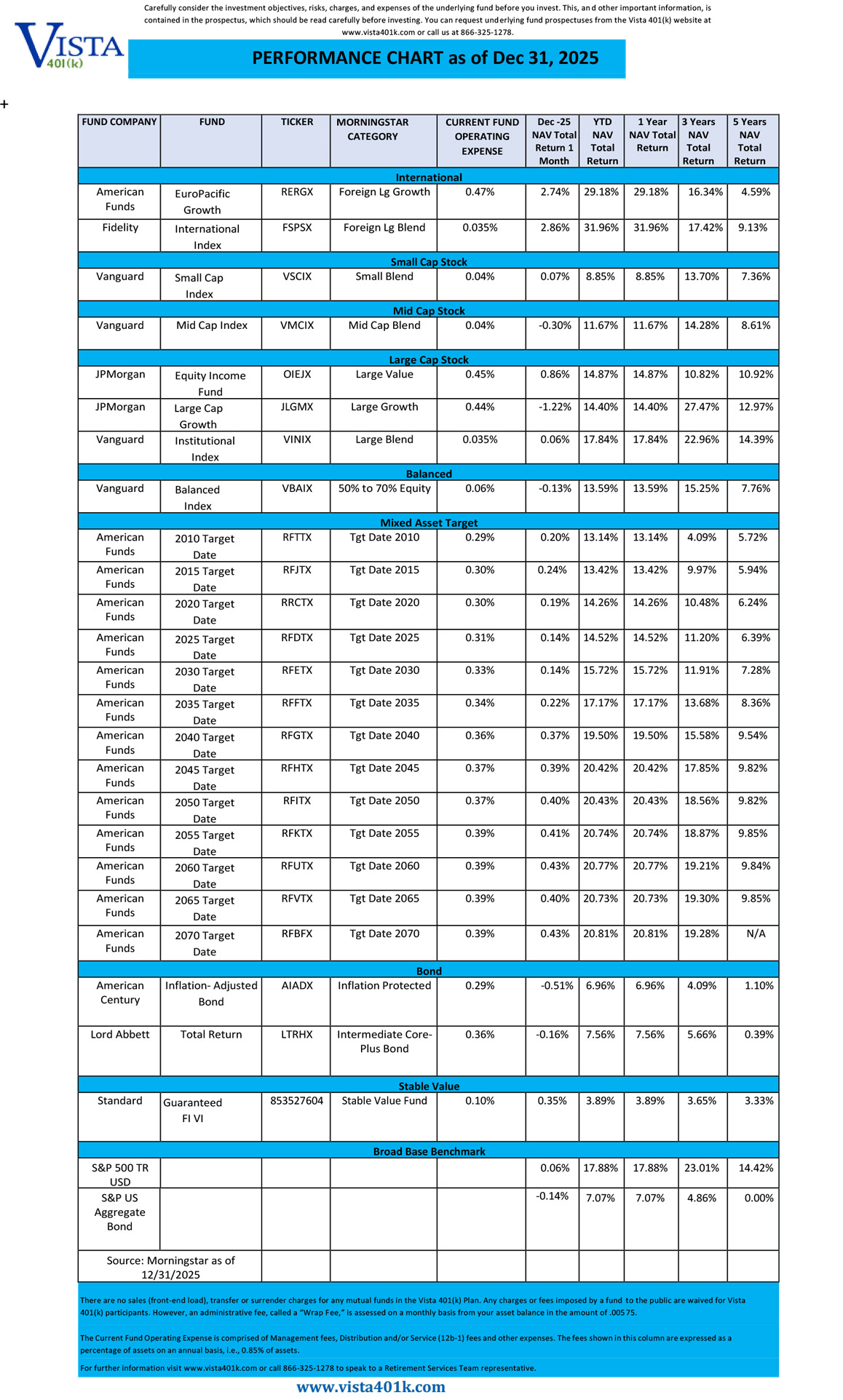

December 2025 Fund Performance Chart

Investing – A New Year’s Resolution

As the New Year begins, many people set resolutions focused on improving their health, productivity, or personal relationships. One resolution that often receives less attention—but can have a lasting impact—is investing in a Vista 401(k) plan. This New Year’s resolution is a practical and forward-looking decision that can strengthen long-term financial security and create positive habits that last well beyond the year.

A Vista 401(k) plan is an employer-sponsored retirement plan that allows employees to contribute a portion of their paycheck toward retirement. One of its greatest advantages is consistency. Contributions are deducted automatically from each paycheck, making it easier to consistently save. By resolving to start or increase Vista 401(k) contributions in the New Year, individuals can turn saving into a routine rather than a one-time effort.

For those who are new to investing, the start of a new year is an ideal time to begin. Your employer allows you to enroll or change your contribution at any time, making it simple to act early in the year. Even small contributions can make a meaningful difference over time due to the power of compounding. Money invested today has more time to grow, and investment gains can generate additional returns year after year. Starting now, rather than waiting for the “perfect” financial moment, can significantly improve retirement outcomes.

Opening a vista 401(k) account can also provide tax advantages. Traditional 401(k) contributions are made on a pre-tax basis, which can reduce taxable income and potentially lower the amount owed in taxes for the year. This immediate benefit can make it easier to stay motivated and see tangible rewards from a New Year’s resolution. The Vista 401(k) plan also offers a Roth 401(k) option, allowing participants to pay taxes upfront and enjoy tax-free withdrawals in retirement.

Beyond the financial benefits, investing in a 401(k) as a New Year’s resolution encourages long-term thinking. It shifts the focus from short-term spending to future stability and independence. Regularly reviewing contributions, investment choices, and financial goals can build confidence and financial awareness. In addition, all who open a Vista 401(k) account gain access to Cerity Partners, a Registered Investment Advisory firm, at no additional cost to you, the participant. They will walk you through the complexities of investing to make certain you are properly diversified and invested based on your risk tolerance, time horizon, and financial goals. Cerity’s financial assistance is not limited to the Vista 401(k) plan. To speak with them, open a Vista 401(k) account, call (866) 325-1278, and ask to speak to a Cerity Partner’s representative.

Ultimately, choosing a Vista 401(k) plan as a New Year’s resolution is about prioritizing your future self. It is one of the most impactful commitments you can make. By starting the year with a clear plan to invest consistently, you lay the foundation for a more secure and comfortable retirement.

Why You Should Invest in your Vista 401(k) Plan Today

One of the smartest financial decisions you can make is to start investing in your Vista 401(k) plan today. Whether you are just entering the workforce or beginning a new job, delaying contributions can cost you tens or even hundreds of thousands of dollars over your lifetime. Time, consistency, and discipline are the three most powerful advantages an early investor has—and a Vista 401(k) plan is designed to maximize all three.

The primary reason to invest early is the power of compound growth. Compounding occurs when your investment earnings begin generating earnings of their own. The earlier you start, the more time your money has to compound. For example, someone who begins contributing to their Vista 401(k) account at age 25 and invests consistently may end up with significantly more retirement savings than someone who waits until age 35, even if the later investor contributes more each month. Time in the market often matters more than timing the market.

Tax advantages also make early Vista 401(k) investing especially powerful. Traditional 401(k) contributions are made with pre-tax dollars, reducing your taxable income today. This allows you to invest more upfront while potentially lowering your current tax bill. Roth 401(k) contributions, on the other hand, are made with after-tax dollars but allow for tax-free withdrawals in retirement. Starting early gives you flexibility to choose the option that best fits your long-term tax strategy.

Investing early also helps build positive financial habits. When contributions are automatically deducted from your paycheck, saving becomes effortless and consistent. You learn to live on what remains rather than trying to save whatever is left over at the end of the month. This discipline can carry over into other areas of your financial life, such as budgeting, emergency savings, and debt management.

Finally, starting early reduces future financial stress. The longer you wait, the more pressure you place on yourself to “catch up” later in life. Higher required contributions can feel overwhelming and may force difficult tradeoffs. Early investing spreads the responsibility over many years, making retirement savings more manageable and less stressful.

In short, investing in your Vista 401(k) account as soon as possible gives you the advantage of time, compounding, tax benefits, and strong financial habits. The earlier you begin, the easier it becomes to build long-term financial security and confidence. Your future self will thank you for starting today.

Traditional 401(k) Plan and Roth 401(k) Plan Explained

A Traditional 401(k) plan and a Roth 401(k) plan are two popular employer-sponsored retirement savings options. While both are designed to help employees build long-term financial security, they differ in how contributions and withdrawals are taxed. Understanding these differences can help individuals choose the option that best aligns with their financial goals and expectations for retirement.

A Traditional 401(k) plan allows employees to contribute a portion of their paycheck on a pre-tax basis. This means contributions are deducted from income before federal income taxes are applied, lowering an employee’s taxable income in the year the contribution is made. For example, if an employee earns $60,000 and contributes $6,000 to a 401(k), they are taxed as if they earned $54,000. The investments within the account grow tax-deferred, meaning no taxes are paid on investment gains while the money remains in the plan. Taxes are only paid when funds are withdrawn, typically during retirement. At that time, withdrawals are taxed as ordinary income.

A Roth 401(k) plan, by contrast, uses after-tax contributions. Employees pay income taxes on their earnings first and then contribute to a Roth 401(k) plan. Because taxes are paid upfront, qualified withdrawals in retirement – including both contributions and investment earnings – are generally tax-free. This can be a significant advantage for individuals who expect to be in a higher tax bracket in retirement or who value the certainty of knowing their retirement income will not be subject to future income taxes.

Contribution limits for traditional and Roth 401(k) plans are combined, meaning a separate IRS limit does not apply to each type of investment.

Choosing between a Traditional 401(k) and a Roth 401(k) depends on several factors, including current income, expected future income, and personal tax strategy. Younger workers or those early in their careers may favor a Roth 401(k) if they anticipate higher earnings later in life. Paying taxes now at a lower rate can result in substantial tax savings over time. On the other hand, individuals in higher tax brackets may prefer a Traditional 401(k) to reduce their current tax burden and potentially pay lower taxes in retirement. Please consult your accountant to determine which strategy works for you.

Employees are allowed to split contributions between both types of plans, creating tax diversification in retirement. Ultimately, both a Traditional 401(k) and a Roth 401(k) are powerful tools for retirement planning. Understanding how each work can help individuals make informed decisions that support long-term financial stability.

If you have any questions, please contact the Retirement Services Department at (866) 325-1278. You may also contact Cerity Partners, a Registered Investment Advisory firm offered at no additional charge, once you have established a Vista 401(k) account.

Nuts & Bolts: Trump Accounts or a Baby Bonus

The following article is unrelated to the Vista 401(k) Plan. We are providing this information so eligible employees understand this new legislation and do not miss an opportunity to save for their newborn child.

Under the tax and spending law passed in 2025 (often referred to as the One Big Beautiful Bill Act), the federal government provides a one-time $1,000 seed deposit into a special investment account for each U.S. baby born between January 1, 2025, and December 31, 2028.

These are not direct cash checks to parents for immediate use — the money is deposited into a tax-advantaged investment account set up for the child.

How Accounts Work

- Automatic Deposit: Once the account is opened, the U.S. Treasury deposits the $1,000.

- Investment Growth: Funds are invested in a broad U.S. stock index (like the S&P 500) or equivalent. Earnings grow tax-deferred until withdrawal.

- Private Contributions: Parents, relatives, employers, and others can contribute up to $5,000 per year to the account to build savings. Federal or charity contributions don’t count against that cap.

- Access at Adulthood: The child can access the account when they turn 18 (or later), and withdrawals can be used for certain purposes such as college, job training, starting a business, or a down payment on a home. Withdrawals are taxed, usually at capital gains rates.

Who Is Eligible

- Babies born in the U.S. between Jan. 1, 2025, and Dec. 31, 2028.

- Must be U.S. citizens with a Social Security number (parents must have SSNs to open accounts).

- Families can open accounts for older children without the $1,000 deposit.

Purpose and Rationale

The policy’s stated goal is to give every child a financial head start and encourage long-term wealth building from birth by taking advantage of compound investment growth over many years.

How to Open an Account

- Parents or guardians must file IRS Form 4547 to establish the account and claim the $1,000 deposit from the federal government.

- This form may be filed when you file your tax return (for example, as part of your 2025 return), or through an online process once the official system is live.

- The form essentially elects to open an account and triggers the government seed money for eligible babies.

Please contact your accountant for additional details.

The DROP Box

- Are you enrolled in DROP and close to retiring?

- Do you have questions about what to do with your DROP benefits?

- Would you like to speak with a 401(k) Plan Specialist about your distribution options?

CALL 866-325-1278 or EMAIL 401k@vista401k.com

When you retire, you don’t have the option of leaving your DROP benefits with the State of Florida. You are required to select a payout method from the following three choices:

- Lump Sum Distribution – less income tax withholding (under age 55, an additional 10% tax penalty withheld)

- Direct Rollover – no tax withholding

- Partial Distribution and Direct Rollover – some income tax withholding

Here are some good reasons to rollover the DROP payout into a Traditional Vista 401(k) account:

- If you take the DROP funds as a payment directly to yourself, these funds will be taxable income for the current tax year.

- If you qualify for normal retirement from the School Board and reach the age of 55, you qualify to withdraw your funds without incurring the age 59½ withdrawal penalty from your Traditional 401(k) Plan. This means that if you choose to rollover your DROP funds to your Traditional Vista 401(k) Account, instead of a traditional IRA, you can withdraw funds before age 59½, without a penalty.

If you entered DROP in 2020, your DROP benefit will be distributed in 2025.

We also accept rollovers from your BENCOR, 403(b) or 457 accounts, so you can have all of your retirement funds in one convenient account. Call us at 866-325-1278 or email us at: 401k@vista401k.com for one-on-one support from our experienced Retirement Services Team.

Helpful Links

The material herein is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations. Situations differ among individuals and you should not assume that these generalizations or information apply to you. Keep in mind that past performance is no guarantee of future performance, and investments involve the risk of loss of principal and earnings. Additionally, neither your employer nor the plan administrator nor FBMC is able to provide you with investment advice–if you would like specific investment advice, you should consult Cerity Partners or your own personal investment advisor.

Home | About Us | 401(k) Plan |401(k) Funds | Learning Center | Blog | Contact Us

P.O. Box 1878 Tallahassee, Florida 32302-1878

866-325-1278